Explain Different Continuation and Reversal Patterns

Different types of Reversal Patterns Head and Shoulders Pattern Inverted Head and Shoulders Pattern Double Top Reversal Pattern Double Bottom Reversal Pattern Falling Wedge Reversal pattern Rising Wedge Reversal Pattern. Double Tops and Bottoms.

Chart Patterns Stock Chart Patterns Trading Charts Stock Charts

Reversal Chart Patterns.

:max_bytes(150000):strip_icc()/dotdash_Final_Continuation_Patterns_An_Introduction_Jul_2020-01-3545a8ca01b94663a186308a5d7a5c5f.jpg)

. Continuation patterns reversal patterns and bilateral patterns. And some other relevant things to master the worlds most traded and strongest trend reversal candlestick patterns to trade the forex and stock successfully to turn yourself a consistent trade winner. There are many different patterns with various suggestions depending on the situation.

The double top. Using chart patterns for swing trading is also pretty important. The name of the type explains the idea of the reversal patterns.

Reversal chart patterns indicate that a trend may be about to change direction. For example suppose you have a bullish trend and the price action creates a trend reversal chart pattern there is a big chance that the previous. It can signal both continuation and reversal.

If the trend is up the bearish rectangle acts as a reversal pattern. A reversal pattern signals that the trend is about to reverse after the pattern has completed itself. Continuation patterns reversal patterns and bilateral patterns.

Reversal patterns on the other hand usually leads to a reversal or. They usually reverse the current price trend causing a fresh move in the opposite direction. Reversal chart patterns indicate that a trend may be about to change direction.

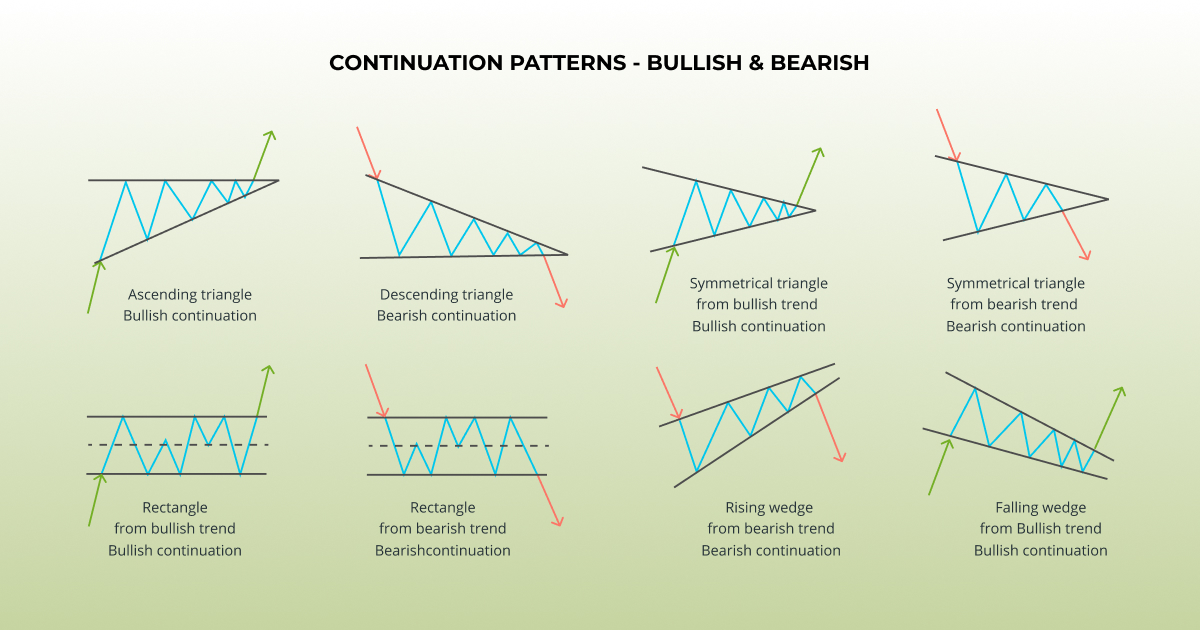

Continuation patterns are their name suggests usually leads to a continuation of the prior price trend. If the trend is down it acts as a continuation pattern. Reversal Patterns Head and Shoulders.

Now let us take an example of an inverse head and shoulders pattern. Dark Cloud Cover Continuation Candlestick Patterns. There are two major types of chart patterns.

Both the tweezer candlestick make almost or the same high. Continuation patterns are an indication traders look for to signal that a price trend is likely to remain in play. Opposite of that the lower three patterns should be traded with a put option.

The candles body is small. Some common reversal chart patterns are the inverse head and shoulders ascending triangle and double bottom. A continuation pattern tells you the trend will continue once the pattern is complete.

Sometimes a trend reversal candlestick pattern act as a trend continuation pattern which is very much necessary to detect as a price action trader to trading forex and stocks. Measured Move - Bullish. The head and shoulders pattern is one of the most famous and most recognizable of all reversal.

A continuation signals that an ongoing trend will continue. When the Tweezer Top candlestick pattern is formed the prior trend is an uptrend. Bearish Candlesticks reversal patterns are.

A continuation signals that an ongoing trend will continue. Reversal chart patterns can also be trend continuation patternsthe context is what matters. It works the same way.

These are the figures which are created at. The Tweezer Top pattern is a bearish reversal candlestick pattern that is formed at the end of an uptrend. On the other hand reversal patterns are opposite to continuation patterns.

Continuation Correctional StructurePattern Bullish Bearish Flag Bullish Bearish Pennant Parallel Channel Reversal Correctional StructurePattern Ascending Descending Channel Rising Falling Wedge Double Top Bottom Head Shoulder PatternInverse H and S M and W style pattern Reversal Impulse Price Action I will forward all the price action structurespatterns. These patterns predict the trend will turn in the opposite direction after their formation. Different testing methodologies to evaluate the robustness of the results controlling for risk and non-risk factors and assess the validity of alternative hypotheses that have been put forward to explain continuation and reversal patterns in returns.

Bearish reversal patterns appear at the end of an uptrend and mean that the price will likely turn down. You can use chart patterns for day trading. In other hand identifying that the bulls or bears have lost control and there may be a change of trend is what reversal patterns do.

It is impossible to tell immediately if a temporary price correction is a pullback or the continuation of the reversal. Inverse Head and Shoulders. Every reversal chart pattern has 3 components to it.

Continuation and reversal patterns. Note that we have classified these chart patterns by whether they are typically reversal or continuation patterns but many can indicate either a reversal or a continuation depending on the circumstances. However there is a third one that combines both types called bilateral patterns.

The reliability of this pattern is very high but still a confirmation in the form of a white candlestick with a higher close or a gap-up is suggested. 1 trending vs retracement move 2 lower highs and higher lows 3 time factor. Well show you popular forex patterns and explain them one by one.

Chart patterns fall broadly into three categories. Measured Move - Bearish. Chart patterns fall broadly into three categories.

When each of these patterns are confirmed we expect a price move equal to at least the size of the actual pattern. You are likely to see them in the middle of a trend when the price is taking a pause and forms a consolidation to build up the strength for the next leg of movement. Spinning top Identifying the Strongest Candlestick Reversal Patterns.

The change can be a. These patterns occur in the middle of. There are two important types of patterns.

Bilateral chart patterns let traders know that the price could move either way meaning the market is highly. Continuation patterns identify opportunities for you to continue with that trend weather is going up or down. Trend Reversal Chart Patterns.

It consists of two candlesticks the first one being bullish and the second one being bearish candlestick.

This Is About Type Of Reversal Pattern Continuation Pattern And Bilateral Pattern In Forex Tradi Trading Charts Stock Chart Patterns Technical Analysis Charts

:max_bytes(150000):strip_icc()/dotdash_Final_Continuation_Patterns_An_Introduction_Jul_2020-01-3545a8ca01b94663a186308a5d7a5c5f.jpg)

Continuation Patterns An Introduction

Chart Patterns For Crypto Trading Trading Patterns Explained

No comments for "Explain Different Continuation and Reversal Patterns"

Post a Comment